This story was first published on Flying Solo.

Just as we often put off checking under the car bonnet, for oil, water, and coolant to keep things running smoothly, small agency owners often fail to check under the bonnet of business finances regularly enough to make sure everything’s in order there too.

Part of what I do at The Possibility Partnership is offer financial health checks for businesses that either don’t have the in-house expertise to do it themselves or want a second (maybe more objective?) set of eyes to get a deeper understanding of their numbers, forecasts and what it all means.

Successful agencies know how to look at their business financials in a particular way to gain true insight into financial performance and the health of their business, particularly one which relies on knowledge skills.

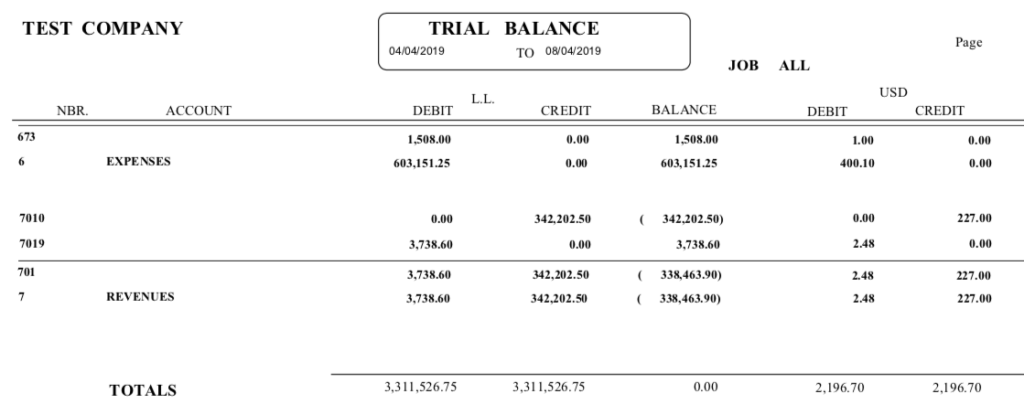

Management reporting – both actual monthly results and budgets – highlight the key drivers for the business, real revenue (not billings), the cost of the people that generate that revenue (the ratio between those two probably being the most influential performance metric) and also a view into those overheads which might be more discretionary and variable.

Results should be looked at month by month, so key trends can be quickly understood with the benchmarks often being the previous month, or the same month last year to allow for seasonality.

Excel, MYOB or XERO – it’s not just the software, it’s the added financial insight you need

Smaller, independent businesses may not (yet) be aware of how to look at their business performance or what the right measures and metrics will be to show how they are travelling along the path to profitability.

In smaller agencies, and particularly in startups, the focus is on winning clients and doing good work for them, (and getting some cash coming in!) Having a meaningful look at the finances, especially one looking forwards and not backwards, can often be “something we will get around to when we have more time”.

In these instances, the default is often to just use the “standard” reports coming out of your software solution. In some instances, this is just a trial balance (a list of numbers), not even a management report, but hey it’s the easy option.

The information that financially successful agencies get out of their software packages needs to be tailored to the business’s needs, to highlight what’s important for their particular activities.

Typically, agencies or consultancy businesses do not manufacture, don’t carry inventory, and are a people business. Agencies sell our ideas, our creativity, and our solutions. The financial view into the business needs to understand that, and continually measure the revenue we earn for those ideas and solutions, against the cost of the people creating and delivering them.

Ask your software providers if they do more specialised reports, something more relevant to your business.

These days it’s also quite common to be able to export the basic information into your own customised Excel reports – these reports need to be meaningful to help you really understand your business, and take the right decisions to maximise your profitability. Sure, there’s a one time set up effort (or cost, if you outsource it), but once you have it you will never look back.

Don’t wait for your next big trip to check under the bonnet, make it a regular habit, your business will perform much better for it.